Jump to:

JobKeeper PaymentsUnder the JobKeeper Payment, businesses significantly impacted by the Coronavirus outbreak will be able to access a subsidy from the Government to continue paying their employees. This assistance will help businesses to keep people in their jobs and re-start when the crisis is over. For employees, this means they can keep their job and earn an income – even if their hours have been cut. The JobKeeper Payment will also be available to the self-employed.The Government will provide $1,500 per fortnight per employee for up to 6 months. The JobKeeper Payment will support employers to maintain their connection to their employees. These connections will enable business to reactivate their operations quickly – without having to rehire staff – when the crisis is over. Click here for more information on the JobKeeper Payment | |||||||

Dealing with Employees of Affected BusinessesThe Fair Work website is another great source of information. Click below to go there. Federal Government Assistance

This will reduce the cost of retaining employees because it is only necessary to pay the employee the net wage (after deducting the PAYGW). Whilst not explicitly stated in the Treasury fact sheet, it is presumed that this payment will be available for all employees, even if the employee is the ‘owner’ of the business (except sole traders, who can’t legally employ themselves). The employer must have been established prior to 12 March 2020, except for charities which can be established after this date. Eligible employers that pay wages will receive a minimum payment of $10,000 even if their total withholding is less than $10,000. This includes the situation where the employer pays employees but is not required to withhold because staff are below the threshold for withholding tax. The benefit will be provided by way of a credit to the employer’s Integrated Client Account with the ATO. If this puts the employer in a credit position, the excess will be refunded by the ATO within 14 days. The first benefit will be paid from 28 April 2020 when the employer lodges their Activity Statements, as outlined below. Quarterly PAYGW lodgements For quarterly lodgers of PAYGW, the payment will be credited to their ATO Integrated Client Account when they lodge their BAS for the period ending March 2020 and June 2020. This means that the PAYGW will not need to be paid to the ATO on the March and June BAS. Monthly PAYGW lodgements Monthly lodgers will be eligible to receive the payment when they lodge their March, April, May and June 2020 Activity Statements. The first payment will be equal to 300% of the PAYGW in the March 2020 Activity Statement (capped at $50,000). This is intended to (approximately) equate to the PAYGW for January, February and March 2020. If this puts the Integrated Client Account in credit, any excess will be refunded by the ATO. The remaining payments will be equal to the PAYGW in the April, May and June 2020 activity statements. However, the aggregated total payment received for March, April, May and June cannot exceed the $50,000 maximum. In some cases, the 300% payment for the March activity statement may mean that the total ‘credit’ received by the employer may exceed the PAYGW for the March to June quarters, as shown in the following example from the Treasury fact sheet: Example 2 Sarah owns and runs a building business in South Australia and employs 8 construction workers on average full-time weekly earnings, who each earn $89,730 per year.

Sarah reports withholding of $15,008 for her employees on each of her monthly Business Activity Statements (BAS). Under the Government’s changes, Sarah will be eligible to receive the payment on lodgement of her BAS.

Sarah’s business receives:

Second Benefit – Additional PaymentTo qualify for the Additional Payment, the entity must continue to be active. The Additional Payments will be delivered as an automatic credit to the Integrated Client Account with the ATO (and refundable if in credit). The minimum Additional Payment is $10,000 and the maximum Additional Payment is $50,000. Quarterly PAYGW lodgements Quarterly lodgers will receive the Additional Payment as a credit to their ATO Integrated Client Account upon lodgement of their Activity Statements for June 2020 and September 2020. For quarterly lodgers, each Additional Payment will be equal to 50% of the amount paid under the First Benefit. Example 3 In the March 2020 BAS, Employer withheld $6,000 from its employees’ wages. In the June 2020 BAS, Employer withheld $8,000 for its employees’ wages. The $14,000 in PAYGW for these quarters will have been credited to the Integrated Client Account by the First Benefit. The first Additional Payment will be equal to 50% of the First Benefit ($7,000) and applied against the September 2020 activity statement. The second Additional Payment will be equal to 50% of the First Benefit ($7,000) and applied against the December 2020 activity statement. Monthly PAYGW lodgements Monthly lodgers will receive the Additional Payment as a credit to their Integrated Client Account when they lodge their June, July, August and September Activity Statements. For monthly lodgers, each Additional Payment will be equal to 25% of the amount paid under the First Benefit. Example 4 (following on from Example 2) In Example 2, Sarah received a total of $50,000 credited to her Integrated client account. Sarah would receive the following Additional Payments:

Practical examples of combined paymentsExample 5 – Quarterly lodger getting minimum payment Tim owns and runs a small paper delivery business. Tim employs two casual employees who each earn $10,000 per year. In his quarterly BAS, Tim reports withholding of $0 for his employees as they are under the tax-free threshold. Tim’s business will receive:

Example 6 – Quarterly lodger getting more than minimum payment Assume Tim has total withholding of $7,500 for each of the March quarter and June quarters ($15,000 total). Tim’s business will receive:

Example 7 – Monthly lodger below $50,000 cap Company X has total monthly PAYGW of $7,500. Company X will receive credits totalling $45,000 under the first benefit as follows:

Company X will also receive $45,000 in credits as Additional Payments:

Example 8 – Monthly lodger above $50,000 cap Company Y has total monthly PAYGW of $25,000. Company Y will receive credits totalling $50,000 under the first benefit as follows:

Company X will also receive $50,000 in credits as Additional Payments:

Apprentice SupportSmall businesses employing fewer than 20 full-time employees who retain an apprentice or trainee will be eligible for support. Eligible employers can apply for a subsidy of 50% of the apprentice or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020 up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter). The apprentice or trainee must have been in training with a small business as at 1 March 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer. Employers of any size and Group Training Organisations that re-engage an eligible out-of-trade apprentice or trainee will be eligible for the subsidy. Employers can register for the subsidy from early-April 2020. Final claims for payment must be lodged by 31 December 2020.

Accelerated depreciation deductions Businesses with aggregated turnover of less than $500 million will also be eligible to claim accelerated depreciation deductions. It seems that this incentive will be relevant for those assets that are not eligible for the instant asset write-off. The accelerated depreciation deduction operates as follows:

This measure will only be available for new assets acquired from 12 March 2020 and first used or installed by 30 June 2021. This measure does not apply to:

Creditor/insolvency relief for financially distressed businessesThe Government will temporarily change a number of measures designed to assist businesses. Statutory demands The minimum threshold for creditors issuing a statutory demand on a company will increase from $2,000 to $20,000. The period of time to respond to a statutory demand will be extended from 21 days to 6 months. The minimum threshold for creditors to initiate bankruptcy proceedings against an individual will increase from $5,000 to $20,000. The period of time to respond to a bankruptcy notice will be extended from 21 days to 6 months. Insolvent trading Directors are personally liable if a company trades while insolvent. Directors will be temporarily relieved of their duty to prevent insolvent trading in respect of any debts incurred in the ordinary course of the company’s business. This will apply for 6 months. Egregious cases of dishonesty and fraud will still be subject to criminal penalties. Income support paymentsA number of extensions and modifications will apply to income support payments for the next 6 months. Coronavirus supplement A coronavirus supplement of $550 per fortnight will be made available to the following payment categories:

Expanded access Jobseeker Payment and Youth Allowance Jobseeker criteria will provide access to the following persons who meet the income tests as a result of the economic downturn due to coronavirus:

In terms of eligibility:

Waiting times also will be reduced:

People will not be permitted, and will need to declare that they are not, accessing employer entitlements (such as annual leave and/or sick leave) or Income Protection Insurance, at the same time as receiving Jobseeker Payment and Youth Allowance Jobseeker under these arrangements. From 20 March 2020, Sickness Allowance was closed to new entrants and was replaced by the JobSeeker Payment. Payments to households The Government is providing two separate $750 payments to eligible persons. First payment To be eligible for the first payment, the individual must be residing in Australia and be receiving one of the following payments, or hold one of the following concession cards, at any time from 12 March 2020 to 13 April 2020, inclusive:

Second payment To be eligible for the second payment, an individual must be residing in Australia and be receiving one of the payments or holding one of the concession cards that were eligible for the first payment as at 10 July 2020. However, this payment will not be made to individuals who are receiving an income support payment that is eligible to receive the Coronavirus supplement. This means that individuals receiving the following benefits will not be eligible for the second payment (because they are eligible to receive the coronavirus supplement):

Early access to superannuation While superannuation helps people save for retirement, the Government recognises that for those significantly financially affected by the Coronavirus, accessing some of their superannuation today may outweigh the benefits of maintaining those savings until retirement. Eligible individuals will be able to apply online through myGov to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation). The exact eligibility requirements will be formed in the coming days but broadly to apply for early release you must satisfy any one or more of the following requirements:

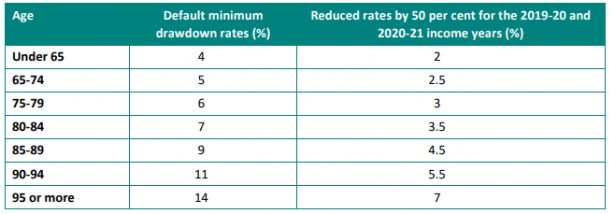

You will be able to apply for early release of your superannuation from mid-April 2020. People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments. If you are eligible for this new ground of early release, you can apply directly to the ATO through the myGov website My Gov Separate arrangements will apply if you are a member of an SMSF. You will be able to apply for early release of your superannuation from mid-April 2020. Reducing superannuation minimum drawdownsThe Government is temporarily reducing superannuation minimum drawdown requirements for account based pensions and similar products by 50 per cent for 2019-20 and 2020-21. This measure will benefit retirees by providing them with more flexibility as to how they manage their superannuation assets.

Individuals who have already taken their minimum pension amount for the 2019/20 financial year will not be able to put that money back into their superannuation account under these changes. Social security deeming ratesAs of 1 May 2020, the upper deeming rate will be 2.25 per cent and the lower deeming rate will be 0.25 per cent. The reductions reflect the low interest rate environment and its impact on the income from savings. The change will benefit around 900,000 income support recipients, including around 565,000 people on the Age Pension who will, on average, receive around $105 more from the Age Pension in the first full year that the reduced rates apply. The changes will be effective from 1 May 2020. SME loan guarantee schemeThe Government will provide a guarantee to assist businesses with a turnover of up to $50 million to borrow money. The Government will guarantee of 50% to lenders for new unsecured loans to be used for working capital. This is to provide an incentive to lenders. The following terms will apply:

Loans will be subject to lenders’ credit assessment processes with the expectation that lenders will look through the cycle to sensibly take into account the uncertainty of the current economic conditions. Responsible lending obligationsThe Government is providing an exemption from responsible lending obligations for lenders providing credit to existing small business customers. This exemption is for six months, and applies to any credit for business purposes, including new credit, credit limit increases and credit variations and restructures. HyperlinksFurther details can be found at the Treasury website: https://treasury.gov.au/coronavirus ATO Assistance & Deferrals

NOTE: Super Guarantee must still be paid on time. Bank Assistance

For specific details on each bank support options please visit their websites via the below links. CBA NSW GovernmentSmall Business Support Grant $10,000 grant will be available to eligible small businesses and non-profit organisations that have been highly impacted & experienced at least a 75% decline in revenue as a result of the NSW public Health Order made on 31 March 2020. This grant is aimed to support businesses with unavoidable business expenses that are not supported by other government funding such as, but not limited to;

Business

ACT GovernmentHouseholds

Businesses

VIC GovernmentBusiness Support Fund $10,000 grant per business is available to eligible business who have been subject to closure or highly impacted by Restricted Activity Directions issued by the Deputy Chief Health Office to date. This grant is aimed to support businesses with business expenses such as;

Businesses

| |||||||

|

|

|

|

Liability limited by a scheme approved under Professional Standards Legislation.

© Copyright Janjua & Co. All rights reserved. |