Jump to:

ATO Agent Nomination Requirements: | ||||||||||||||||||||||||

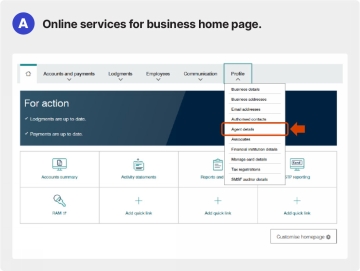

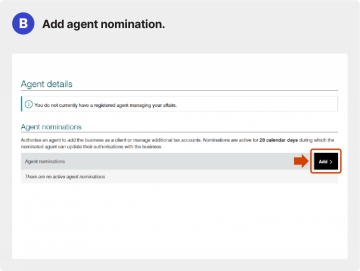

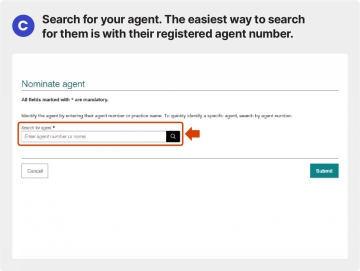

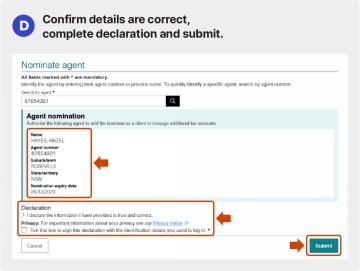

Effective from 13 November 2023, the agent nomination process will apply to all types of entities with an ABN excluding sole traders. ATO requires all entities with an ABN (excluding Sole Traders) to link their business to their BAS or tax agent. This client-to-agent linking process must be completed before your tax agent can view your ATO profile or act as your BAS or tax agent. You can follow steps provided by ATO https://www.ato.gov.au/tax-and-super-professionals/digital-services/in-detail/client-agent-linking-steps, to link use and provide access to your ATO record. Here is step by step guide: | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

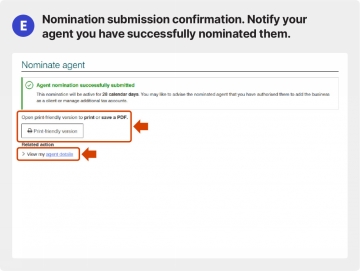

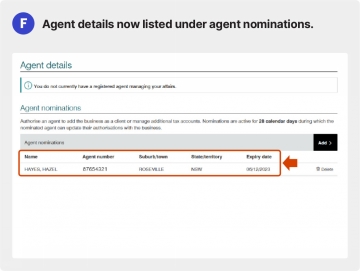

The following screenshots will assist you to nominate your agent in Online Services for Business. | ||||||||||||||||||||||||

|

|

|

Liability limited by a scheme approved under Professional Standards Legislation.

© Copyright Janjua & Co. All rights reserved. |